Nestle SA (NESN:VX; NSRGY:OTC) has recently introduced several healthful or plant-based foodstuffs as part of a long-term move away from sugary snacks. It recently launched Maggi Soya Chunks, a plant-based meat alternative marketed in Africa to enable consumers there to add protein to their everyday food.

Another new launch is a range of plant-based alternatives to white fish, including nuggets, fingers, and fillets. It is also bringing back its "Voie Gras" alternative to foie gras for a limited time and only in selected northern European countries.

"N3" is made from cow's milk but with added prebiotics and low-lactose, is being test-marketed in China. Many of these and similar products over the last year and more can be expensive to develop and market, and many are niche markets, but they are part of a broad strategy that may prove profitable over the long term.

Nestle is a Buy for long-term investors.

Pan American's New Mine: Long Life but Expensive

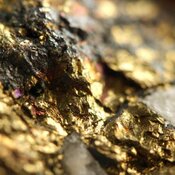

Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) released a Preliminary Economic Assessment (PEA) on its La Colorada skarn project, with strong return metrics but a high capital cost. The project, essentially a new cave mine underneath its existing La Colorado mine, is a large, long-life polymetallic project.

The project, with production expected to start in 2033, will have a 17-year mine life and 14% internal rate of return, with 60% of the value from zinc and 20% each from lead and silver. The capex is estimated at $2.8 billion, with a payback of 4.3 years. The estimated start date, after a six-year construction period, fits well with the depletion of the current mine.

The capex came in higher than the market was expecting. Because of the large amount of base metals and the high capex, the company is looking to partner with the project, keeping the silver for itself. This large project adds to Pan American's net asset value.

Hold.

TOP BUYS this week in addition to above include Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Altius Minerals Corp. (ALS:TSX.V), Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American), Midland Exploration Inc. (MD:TSX.V), Lara Exploration Ltd. (LRA:TSX.V), Orogen Royalties Inc. (OGN:TSX.V), and Hutchison Port Holdings Trust (HPHT:Singapore).

| Want to be the first to know about interesting Gold, Special Situations and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Pan American Silver Corp., Franco-Nevada Corp., Altius Minerals Corp., Metalla Royalty & Streaming, Midland Exploration Inc., Lara Exploration Ltd., and Orogen Royalties Inc.].

- [Adrian Day]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [All]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.